FinTech startups in 2025 need specialized strategies to gain visibility in AI-powered search results.

With Lureon's combination of Generative Engine Optimization (GEO) tactics and Retrieval-Augmented Generation (RAG) integration providing a proven framework for increasing citations across ChatGPT, Perplexity, Claude, and other AI platforms in 2025.

Key Takeaways

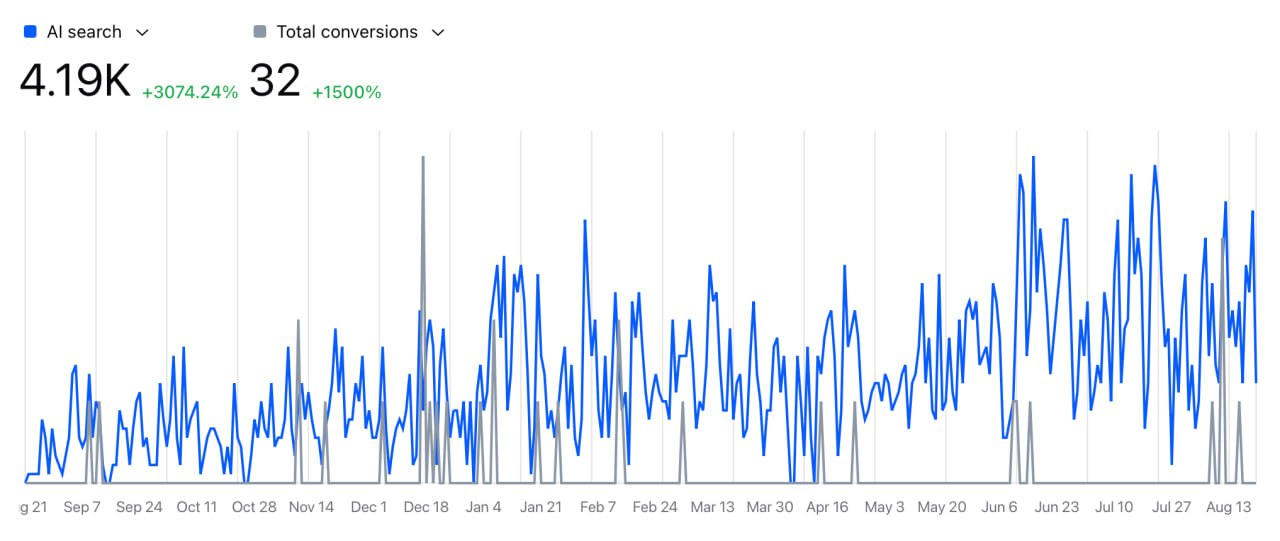

- AI citations now drive 2x higher conversion rates despite representing only 0.13% of total traffic, making GEO essential for FinTech visibility

- FAQ schema markup increases AI citations by 750% while proper entity mapping generates 33% longer sessions and 2.1x higher CTRs

- Lureon's AI engine trained on tech startup data delivers results 70% faster than traditional SEO agencies at 40-60% lower costs

- RAG integration enables real-time data freshness and contextual relevance, critical factors for AI citation in rapidly changing FinTech markets

- Small businesses implementing Lureon's GEO strategies see 65% visibility increases within 3 months through automated optimization and citation tracking

The AI Citation Landscape for FinTech in 2025

Current State of AI-Powered Search

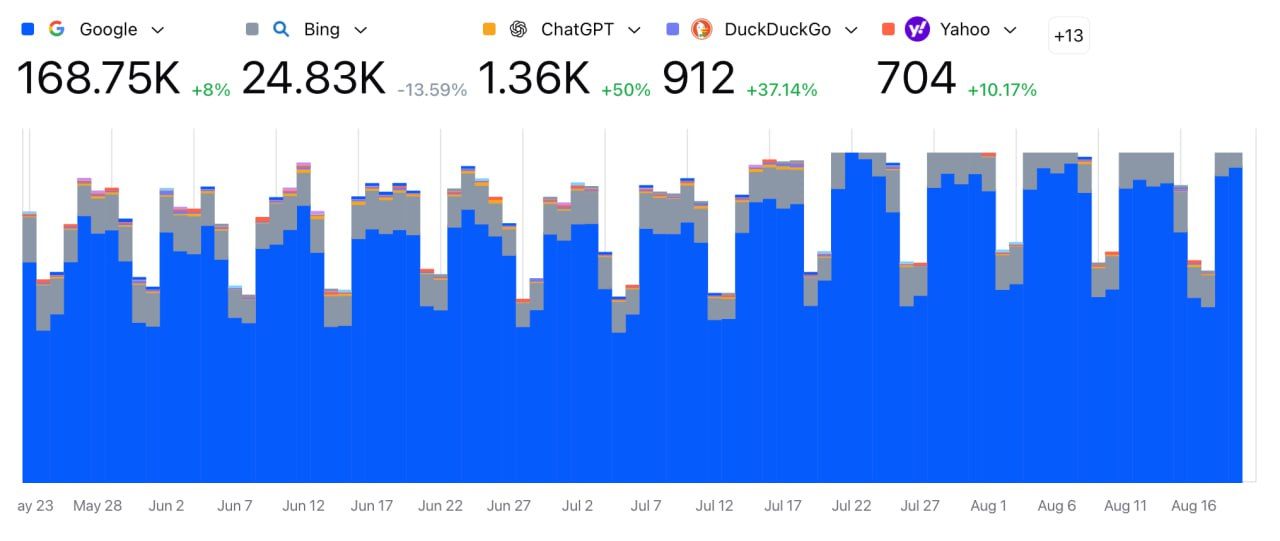

AI search has fundamentally transformed how users discover financial technology solutions.

ChatGPT processes over 10 million daily queries while becoming the 5th most visited site globally.

- For FinTech startups, this shift creates both challenges and opportunities.

Traditional search engines now compete with AI interfaces that provide direct answers rather than lists of links.

Research shows AI search reduces website clicks by 30% while 60% of searches now end without clicks, making citation optimization critical for maintaining visibility.

Why FinTech Needs Specialized GEO Approaches

FinTech companies face unique challenges in AI visibility due to regulatory requirements, technical complexity, and trust factors.

- Generic SEO strategies fail to address these sector-specific needs.

LLM traffic converts at twice the rate of traditional traffic despite representing only 0.13% of visits, demonstrating higher user intent when AI systems recommend financial solutions.

This quality traffic becomes particularly valuable for FinTech startups targeting specific customer segments.

The technical nature of financial products requires clear, structured content that AI systems can parse accurately.

FinTech terminology, compliance statements, and product specifications need optimization for machine comprehension while maintaining human readability.

Understanding Lureon's GEO Framework

Core Components of GEO for FinTech

Lureon's approach differs from traditional SEO by focusing on citation-worthiness rather than keyword rankings.

The framework includes:

- Entity Mapping: Building connections between your FinTech brand and specific financial concepts, ensuring AI systems recognize your expertise in areas like payment processing, lending, or cryptocurrency.

- Semantic Structuring: Pages that employ entity mapping get 40% more return visitors and deliver 33% longer session times with 2.1x higher click-through rates compared to traditional keyword targeting.

- Citation Forecasting: Using prompt testing to predict how AI systems will reference your content before publication, allowing preemptive optimization.

How Lureon's Technology Works

Lureon's AI engine is trained exclusively on tech startup performance data, providing specialized insights for FinTech companies.

The platform analyzes thousands of successful startup growth patterns to understand what content performs well in AI citations.

The system continuously retrains based on your specific market response data, creating increasingly accurate growth models unique to your FinTech niche.

- This adaptive approach means strategies become more refined over time without manual intervention.

Implementing GEO Tactics for FinTech Startups

Content Structure Optimization

FAQ schema markup leads to a 750% increase in AI citations and 8.5x total reach.

For FinTech startups, this means structuring content around common customer questions about fees, security, compliance, and features.

Proper implementation requires:

- FAQ content visible on page load

- Unique questions matching page topics

- Self-contained answers requiring no additional context

- Clear formatting with proper schema markup

Building Authority Signals

Major media organizations get cited at least 27% of the time across models like GPT-4, Gemini Pro, and Claude.

FinTech startups can build similar authority through:

- External Mentions: Creating profiles on Crunchbase, G2, and industry-specific directories where AI systems frequently source information.

- Regulatory Compliance Display: Clearly displaying licenses, certifications, and regulatory compliance on About pages and author bios helps AI systems assess credibility.

- Technical Documentation: Publishing detailed API documentation, security protocols, and technical specifications in formats AI systems can easily parse.

Multi-Channel Content Distribution

Businesses mentioned in three or more industry publications are 4x more likely to appear in AI-generated recommendations.

Lureon implements systematic multi-channel strategies including:

- Industry publication placements

- Technical forum participation (Stack Overflow, GitHub)

- Financial community engagement (Reddit finance subreddits, Quora finance topics)

- Partnership announcements and co-branded content

RAG Integration for Real-Time FinTech Data

Understanding RAG in Financial Services

Retrieval-Augmented Generation combines live data streams with AI models to ensure accuracy and relevance.

For FinTech companies, this means:

- Real-Time Rate Updates: Interest rates, exchange rates, and fee structures stay current in AI responses.

- Compliance Updates: Regulatory changes reflect immediately in AI-generated content about your services.

- Product Availability: Current feature sets, geographic availability, and partnership integrations remain accurate.

Technical Implementation of RAG

Lureon's RAG implementation for FinTech includes:

- Vector Embeddings: Continuous updates with real-time financial data ensure AI systems access current information.

- API Integration: Direct connections to your systems provide accurate product details, pricing, and availability.

- Temporal Relevance: Time-sensitive financial information receives priority in AI retrieval systems.

Measuring and Tracking AI Citations

Key Performance Indicators

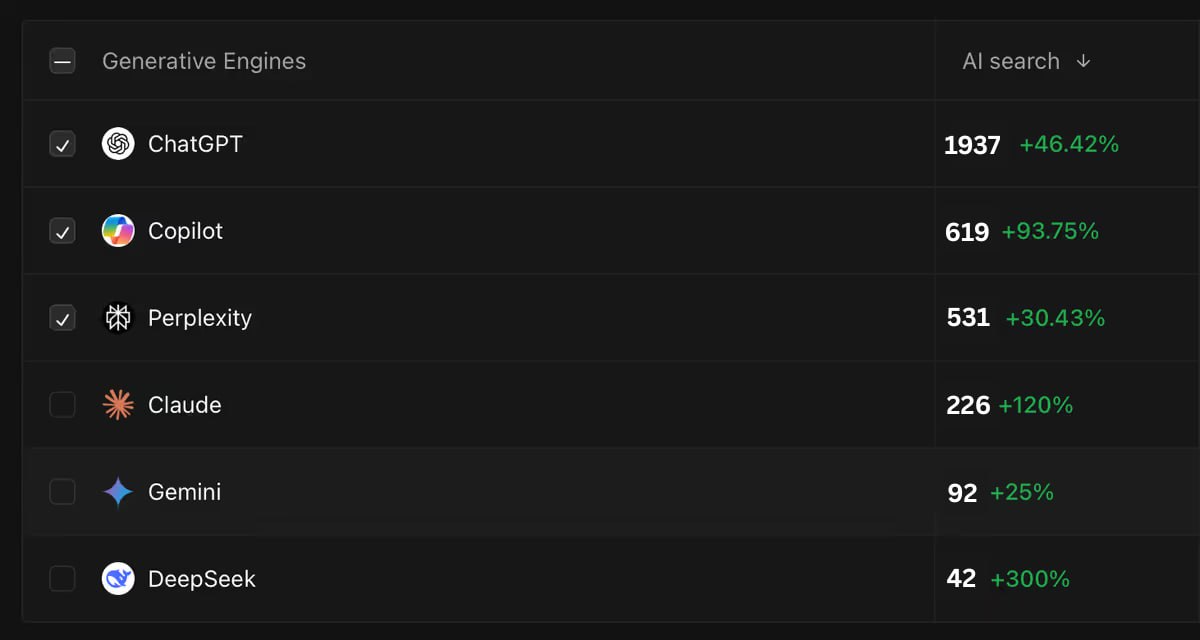

Specialized tools like Promptmonitor work as "Ahrefs for AI answers," showing company mentions when users ask AI assistants for recommendations.

Essential metrics include:

- Presence Rate: How often your brand appears in relevant AI responses

- Cross-Model Consistency: Citation frequency across ChatGPT, Claude, Perplexity, and Gemini

- Sentiment Analysis: How AI systems describe your FinTech services

- Conversion Attribution: Tracking users from AI citations to conversions

Lureon's Tracking Dashboard

The platform provides real-time visibility into:

- Citation frequency by topic and platform

- Competitive positioning in AI responses

- Content performance metrics

- ROI measurement connecting citations to revenue

Tech founders appreciate Lureon's no-nonsense reporting that connects marketing activities directly to revenue metrics, providing daily updates rather than monthly reports.

Services and Solutions by Lureon

For Early-Stage FinTech Startups

Lureon offers flexible pricing tiers based on startup stage and funding level.

Pre-seed and seed stage companies receive:

- Authority building through thought leadership content

- Technical education content for market validation

- Basic GEO implementation with schema markup

- Monthly performance tracking and optimization

For Growth-Stage FinTech Companies

Series A and beyond companies access:

- Competitive positioning strategies

- Advanced RAG integration for real-time data

- Multi-platform citation optimization

- Custom AI visibility dashboards

- Dedicated account management

Agency and Accelerator Programs

Lureon acts as an embedded growth engine for AI search, giving every startup in accelerator cohorts an unfair advantage.

Services include:

- White-labeled GEO content packages

- Cohort-wide AI visibility training

- Portfolio company performance tracking

- Scalable implementation frameworks

Enterprise FinTech Solutions

Large financial institutions benefit from:

- Custom AI citation strategies

- Compliance-focused content optimization

- Multi-product citation management

- Integration with existing MarTech stacks

Getting Started with Lureon

Initial Assessment

The onboarding process begins with a comprehensive analysis of your current AI visibility.

This includes:

- Current Citation Audit: Checking existing mentions across major AI platforms

- Competitive Analysis: Understanding how competitors appear in AI responses

- Technical Readiness: Evaluating website structure and content format

- Goal Setting: Establishing realistic citation and traffic targets

Lureon's assessment process uses crawling technology to analyze how AI systems currently perceive your brand across hundreds of relevant queries.

We provide a detailed gap analysis showing exactly where competitors outperform you in AI visibility and identify quick wins for immediate improvement.

Our technical audit includes specific recommendations for site structure changes, schema implementation, and content reformatting to maximize AI comprehension.

Implementation Timeline

Companies implementing GEO approaches report 65% average visibility increases within just three months.

Typical timeline:

- Week 1-2: Technical setup and schema implementation

- Week 3-4: Content optimization and creation

- Week 5-8: Authority building and distribution

- Week 9-12: Performance optimization and scaling

Throughout the implementation process, Lureon provides weekly progress reports showing citation improvements, traffic gains, and conversion metrics.

Our project management team coordinates all activities, from technical implementations to content publishing schedules, ensuring smooth execution without overwhelming your internal resources.

We also conduct bi-weekly strategy calls to review performance, adjust tactics based on early results, and align ongoing efforts with your evolving business priorities.

Pricing Structure

Lureon's standard packages start at $1200/month, including:

- 4 in-depth GEO-optimized articles

- 4 mini-articles for authority building

- 1 high-quality backlink (DA20+)

- Weekly LLM performance audits

- Weekly reporting and optimization

- 8-hour daily email support

All Lureon packages include access to our proprietary GEO tools, including the AI citation tracker, competitive intelligence dashboard, and content optimization analyzer.

We offer month-to-month contracts with no long-term commitments, allowing startups to scale services up or down based on growth and funding situations.

Custom enterprise packages are available for larger FinTech companies requiring additional services like dedicated account management, custom integrations, or white-label reporting.

Future-Proofing Your FinTech AI Strategy

Emerging Trends in AI Search:

- Voice-First Financial Queries: Optimization for conversational queries about financial products

- Multimodal Search: Integration of charts, graphs, and visual financial data

- Personalized Financial Recommendations: Context-aware AI responses based on user profiles

- Regulatory AI Compliance: New requirements for AI-generated financial content

Continuous Optimization Approach

Lureon's platform adapts to these changes through:

- Regular algorithm updates based on AI platform changes

- Continuous retraining on FinTech-specific data

- Proactive strategy adjustments

- Future-focused content planning

Conclusion

FinTech startups implementing Lureon's GEO tactics see 65% visibility increases within three months through AI-optimized content that earns citations from ChatGPT, Claude, Perplexity, and other LLMs.

Our hybrid optimization combines FAQ schema markup (750% citation increase), entity mapping (2.1x higher CTRs), and RAG integration for real-time data accuracy.

With results 70% faster and costs 40-60% lower than traditional agencies, Lureon transforms FinTech marketing into predictable AI-driven growth.

Get started with Lureon today to become the trusted source AI platforms cite for financial technology solutions.

FAQs:

1. What exactly is Generative Engine Optimization (GEO) and how does it differ from traditional SEO?

GEO is built for AI-first content and requires a fundamentally different approach than traditional SEO. While SEO focuses on ranking websites in search engines like Google, GEO optimizes content to be cited within AI-generated responses from platforms like ChatGPT, Claude, and Perplexity. The focus shifts from keywords and backlinks to structured data, entity recognition, and citation-worthiness.

2. How quickly can FinTech startups expect to see results with Lureon's GEO tactics?

Most clients see initial ranking improvements within 2-4 weeks of implementing Lureon, which is about 70% faster than traditional agencies. Full implementation typically shows significant citation increases within 30 days, with optimal results achieved by the three-month mark.

3. What specific services does Lureon provide for FinTech companies?

Lureon provides comprehensive GEO services including entity-based keyword mapping, prompt-based content testing, landing page optimization, monthly backlink acquisition, schema markup implementation, AI citation tracking across all major LLMs, and real-time performance monitoring. All content is human-written and specifically optimized for both AI citation and human readers.

4. How does RAG integration benefit FinTech startups specifically?

RAG integration ensures your financial data remains current in AI responses, including real-time rate updates, compliance information, and product availability. This is crucial for FinTech companies where outdated information could damage trust or violate regulations.

5. What ROI can FinTech startups expect from investing in GEO?

Companies using proper GEO implementation see LLM traffic that converts at twice the rate of traditional traffic, with some cases showing eight times higher effectiveness. Combined with 40-60% cost savings compared to traditional agencies and 70% faster results, the ROI typically becomes positive within the first quarter.