B2B SaaS lead generation relies heavily on email marketing, used by 88% of businesses, with social media gaining traction among 78% of marketers.

Lureon's 2025 report highlights email’s $36-42 ROI per dollar and LinkedIn’s 97% adoption rate for lead generation. Lead quality, not just volume, is critical, with 54% of marketers focusing on improving conversion rates. Nurtured leads yield 47% larger purchases at 33% lower costs, vital for Series A/B+ companies aiming for growth.

Key Takeaways

- Email marketing dominates ROI with $36-42 return per dollar spent, making it the highest-performing channel despite being one of the oldest digital tactics.

- LinkedIn generates 80% of all B2B social media leads and is 277% more effective than Facebook and Twitter for lead generation.

- Cold calling success rates have plummeted to just 2.3% in 2025, nearly half of 2024's rate, signaling the end of interruptive tactics.

- 78% of sales professionals using LinkedIn automation generate more pipeline than manual outreach, saving over 10 hours weekly per team.

- Quality trumps quantity: nurtured B2B leads produce 47% larger purchases at 33% lower cost than non-nurtured prospects.

Survey Methodology and Respondent Profile

To understand what's driving successful B2B SaaS lead generation in 2025, we conducted a detailed survey that captures the current landscape. Our methodology focused on gathering actionable insights from professionals actively engaged in lead generation activities across various sectors.

Sample size and company types

The data in this B2B SaaS 2025 report comes from a diverse range of organizations. Survey participants were non-Dux-users from companies across the globe, representing both enterprise organizations and SMEs.

This mix ensures the findings reflect real-world practices across different company sizes and maturity levels.

Notably, we included:

- Early-stage startups seeking initial market traction

- Growth-stage companies focused on scaling their customer acquisition

- Established enterprises optimizing their lead generation processes

This diverse sample allows B2B companies of all sizes to benchmark their strategies against peers and industry leaders. The inclusion of both enterprise and SME respondents provides a comprehensive view of what works at different organizational scales.

Geographic and industry distribution

Our respondents span multiple continents, offering a global perspective on B2B SaaS lead generation. This worldwide distribution enables us to identify both universal trends and region-specific nuances in lead generation effectiveness.

From a vertical standpoint, the survey encompasses professionals from:

- Technology and software development

- Financial and professional services

- Manufacturing and industrial sectors

- Healthcare and life sciences

- Education and non-profit organizations

This cross-industry approach reveals which lead generation strategies work consistently across sectors versus those that perform exceptionally well in specific niches. Furthermore, the geographic diversity helps identify regional variations in channel effectiveness and adoption rates.

Role breakdown: marketers vs. sales leaders

One of the most valuable aspects of this lead generation report is its inclusion of perspectives from both marketing and sales professionals.

This dual viewpoint provides a more holistic understanding of the entire lead generation process.

The respondent pool includes:

- Marketing professionals - Primarily focused on top-of-funnel activities, content creation, and initial lead capture

- Sales leaders - Concentrated on qualification, nurturing, and conversion strategies

- Growth specialists - Working across both disciplines to optimize the entire customer acquisition process

This balanced representation allows us to examine how perspectives differ between those generating initial leads and those responsible for converting them into customers. Consequently, the findings highlight where marketing and sales teams align in their assessment of effective channels, and where they don't.

The comprehensive nature of our respondent profile ensures the insights presented throughout this report reflect actual practices driving results for B2B SaaS companies today. As you examine the findings, consider how they apply to your specific business context and growth objectives.

Top Performing Lead Generation Channels in 2025

Our analysis reveals a clear hierarchy among lead generation channels in 2025, with significant shifts in which tactics deliver the highest return on investment for B2B SaaS companies.

1. Email marketing usage and ROI trends

Despite being one of the oldest digital marketing channels, email continues to dominate as the highest-performing lead generation method for B2B SaaS companies.

The numbers speak for themselves: email marketing consistently delivers between $36 and $42 for every dollar invested, making it substantially more valuable than most other channels.

This translates to an impressive 3,600% to 4,000% ROI when implemented effectively.

Beyond the raw return figures, email marketing proves particularly effective with a 261% ROI and a 3.5 return on advertising spend. Though the break-even point typically occurs around seven months, the long-term value makes this investment worthwhile for sustainable growth.

According to our findings, B2B email campaigns average a 2.4% conversion rate. Although this slightly trails B2C campaigns at 2.8%, the higher value of B2B conversions often compensates for this difference. Moreover, email subscribers spend 138% more than non-subscribers, making list building a critical priority.

2. Social media adoption: LinkedIn vs. others

Among social channels, LinkedIn has established itself as the undisputed leader for B2B SaaS lead generation. The platform generates four out of five B2B leads from social media and has been rated the number one platform for B2B lead generation.

Furthermore, 85% of B2B marketers believe LinkedIn delivers the best value compared to platforms like Facebook and YouTube.

The professional network's effectiveness stems from several factors.

- First, LinkedIn is 277% more effective for lead generation than Facebook and Twitter.

- Second, its conversion rates outpace other platforms, with users reporting up to double the standard conversion rates.

- Third, LinkedIn's average conversion rate for Lead Gen Forms stands at 13%, significantly higher than the industry-wide average of 2.35% for landing pages.

For B2B SaaS companies, these statistics translate to tangible benefits: LinkedIn delivers better-qualified leads despite higher costs, with cost per lead 28% lower than Google AdWords. Additionally, 40% of B2B marketers rate LinkedIn as their most effective channel for driving high-quality leads.

3. Decline of cold calling and affiliate programs

Conversely, traditional outreach methods are showing diminishing returns. Cold calling success rates have plunged to 2.3% in 2025, almost half of what they were just a year prior (4.82% in 2024). This decline continues a long-term trend, as Harvard Business Review reported cold calling was ineffective 90% of the time even back in 2010.

Several factors contribute to this decline:

- First, the rise of caller ID and spam filters has created significant barriers.

- Second, smartphone operating systems now routinely flag unknown numbers, in 2023, 28% of all unknown calls were flagged as spam or fraud.

- Third, trust in unsolicited business communications has reached rock bottom, with only 34% of consumers trusting most brands they buy from.

Similarly, affiliate marketing shows mixed results for B2B SaaS. Although long considered effective for B2C companies, few B2B firms are capitalizing on this channel.

Despite its "self-funding" aspect and zero upfront costs, affiliate programs struggle to align with the nurture-based B2B sales cycle.

Overall, this lead generation report confirms that channels fostering trust and delivering value consistently outperform interruptive tactics in today's B2B environment.

LinkedIn as the Core B2B SaaS Lead Engine

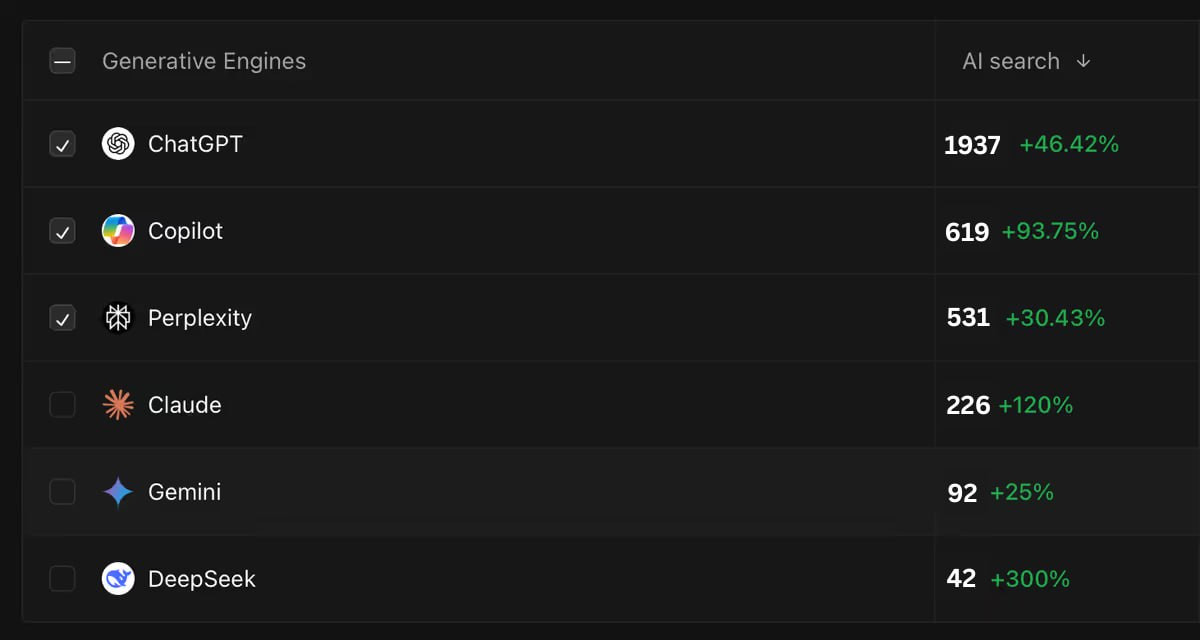

The dominance of LinkedIn as a B2B lead generation powerhouse continues to strengthen in 2025, with the platform firmly establishing itself as the cornerstone of successful SaaS marketing strategies.

Daily usage statistics among B2B marketers

First and foremost, LinkedIn usage among B2B professionals has reached unprecedented levels. Of the 97% of marketers using LinkedIn for lead generation, nearly half use it daily, and 70% use it at least once a week. This high-frequency engagement highlights the platform's central role in modern B2B lead acquisition.

For sales and marketing teams in enterprise businesses, LinkedIn has evolved from an occasional tool to a daily necessity.

Two-fifths (40%) of monthly active users access LinkedIn daily, representing over 100 million professionals that businesses can target regularly. Given these statistics, B2B SaaS companies not actively engaged on LinkedIn are increasingly at risk of falling behind competitors who have established consistent presence on the platform.

LinkedIn vs. Facebook and YouTube for B2B

When comparing social media platforms for B2B lead generation effectiveness, LinkedIn substantially outperforms alternatives:

- LinkedIn is 277% more effective for lead generation than Facebook and X/Twitter

- 85% of B2B marketers report LinkedIn delivers better value than Facebook and YouTube

- 80% of B2B leads from social media come directly from LinkedIn, compared to just 13% from X/Twitter and 7% from Facebook

These stark differences extend to conversion rates as well. LinkedIn generates 3x more conversions than X/Twitter and Facebook, while LinkedIn's Lead Gen Forms achieve an average conversion rate of 13%, substantially higher than the industry standard 2.35% for landing pages.

For B2B SaaS companies specifically, LinkedIn offers advantages beyond raw numbers. The platform's professional environment is more conducive to the type of content typically used in B2B SaaS marketing.

Additionally, LinkedIn's sales-oriented features provide significant advantages for companies employing account-based marketing strategies.

Integration with CRMs and outreach tools

Along with its inherent lead generation capabilities, LinkedIn's value is amplified through powerful integrations with popular business tools. LinkedIn Sales Navigator's Advanced Plus plan features integrate with numerous CRMs and sales platforms including HubSpot Smart CRM, Microsoft Dynamics 365, Oracle Sales, Salesforce, G2, and Tableau.

These integrations yield measurable benefits:

- Average time savings of 65 hours annually per user from reduced tool-switching

- 4x more connections to Director+ leaders compared to non-users

- Self-funding ROI with Sales Navigator paying for itself in less than 6 months

Companies that integrate LinkedIn Sales Navigator with their CRM system have documented improved win rates by 17%, deal sizes by 42%, and pipeline opportunities by 15%.

Furthermore, Forrester research indicates that Sales Navigator users have seen a 10% revenue increase within three years.

These integration capabilities enable B2B SaaS companies to streamline their lead generation processes while maintaining data consistency across platforms, a critical advantage for scaling growth efficiently.

Adoption and ROI of LinkedIn Automation Tools

As LinkedIn solidifies its position as the preferred platform for B2B lead generation, automation tools have become essential for scaling outreach efforts efficiently. This lead generation report examines how these tools are transforming prospecting and engagement for SaaS companies.

Percentage of marketers using automation

The adoption of LinkedIn automation has reached a critical threshold among B2B professionals. Currently, 78% of sales professionals using automation generate more pipelines than those relying solely on manual outreach.

This substantial difference explains why automation has transitioned from optional to necessary for competitive SaaS companies.

First and foremost, automation tools provide remarkable time savings, teams using these solutions save over 10 hours weekly on repetitive LinkedIn tasks. Beyond time efficiency, these tools deliver measurable performance improvements, with automated outreach achieving up to three times higher response rates compared to manual efforts.

Top automation tools used in 2025

The B2B SaaS 2025 report identifies several leading LinkedIn automation solutions that have gained significant market share:

- Cloud-based platforms: Heyou, Expandi, Dripify, and Waalaxy lead in providing safer, less detectable automation

- Outreach specialists: Dripify, Waalaxy, and Expandi excel in message personalization and sequence management

- Prospecting tools: Kaspr, Evaboot, and Lusha focus on list-building capabilities

- Content engagement: Taplio, Heyou, and SocialPilot enhance visibility through content strategy

The most successful tools combine intelligent workflows, personalization capabilities, and safety controls that protect users from LinkedIn restrictions. Accordingly, cloud-based tools have surpassed browser extensions in popularity due to their lower detection risk.

Lead generation vs. brand awareness objectives

For B2B SaaS companies, LinkedIn automation serves distinct strategic objectives.

When evaluating ROI, goals typically fall into two categories:

Lead generation-focused automation yields the most direct financial returns. Teams prioritizing this objective report generating consistent pipeline through multi-step outreach workflows.

The effectiveness stems from automation's ability to maintain persistent follow-up sequences that would be impractical to execute manually.

In contrast, brand awareness automation concentrates on content distribution and engagement at scale. Although harder to measure directly, these efforts build credibility that ultimately supports conversion goals.

The B2B SaaS 2025 report suggests that companies achieving the highest ROI typically combine both approaches, using content-driven brand building to warm prospects before direct outreach.

Challenges in LinkedIn Automation and Outreach

Despite LinkedIn's effectiveness for B2B SaaS lead generation, many companies face significant obstacles when implementing automation strategies. The 2025 lead generation report identifies several critical challenges that impact campaign performance.

Personalization at scale with merge tags

While automation tools promise personalization, basic merge tags often fall short. Indeed, generic templates that only insert names and company information are immediately recognized as mass outreach.

Messages using minimal personalization achieve just 1-3% response rates, whereas highly personalized outreach can reach 15-30%.

Beyond basic merge tags, effective personalization must reference specific prospect activities, company initiatives, and industry challenges.

Daily outreach limits and account safety

LinkedIn enforces strict usage limitations that directly impact campaign planning. Free accounts are restricted to approximately 100 connection requests weekly, whereas paid accounts can send up to 250 weekly.

Exceeding these thresholds triggers temporary restrictions, with repeated violations potentially leading to permanent bans.

First-time violations typically result in account blocks lasting between a few days to one week.

Analytics and integration limitations

Alongside personalization and safety concerns, B2B SaaS companies struggle with analytics gaps. Standard LinkedIn metrics lack the depth needed for ROI assessment, forcing teams to seek advanced analytics through third-party tools.

Furthermore, although automation tools generate comprehensive reports, many struggle with seamless CRM integration, creating data silos between platforms. This fragmentation complicates lead tracking and diminishes the value of automated outreach efforts.

Conclusion

Lureon's 2025 B2B SaaS lead generation report emphasizes email marketing’s $36-42 ROI per dollar and LinkedIn’s 80% share of social media leads as top channels.

Cold calling’s success rate has dropped to 2.3%, while 78% of sales professionals using LinkedIn automation see better pipeline results. Quality leads, nurtured effectively, yield 47% larger purchases at 33% lower costs.

LinkedIn automation saves over 10 hours weekly but demands personalized outreach and adherence to usage limits.

Balancing email and LinkedIn with sophisticated personalization drives sustainable growth.

Read Next:

- Best AEO (Answer Engine Optimization) Startegies for 2026 Explained: How it Differs from Traditional SEO

- Why Combining AEO and SEO is the Ultimate Strategy for Digital Success in 2026

- Best AEO (Answer Engine Optimization) Services for Marketing Agencies in 2026

FAQs:

1. What are the top-performing lead generation channels for B2B SaaS companies in 2025?

Email marketing and LinkedIn are the most effective channels. Email delivers $36-42 ROI for every dollar spent, while LinkedIn generates 80% of B2B social media leads.

2. How effective is cold calling for B2B lead generation in 2025?

Cold calling has become significantly less effective, with success rates dropping to just 2.3% in 2025, making it an increasingly obsolete method for B2B lead generation.

3. What benefits do LinkedIn automation tools offer for B2B SaaS companies?

LinkedIn automation tools can save teams over 10 hours weekly on repetitive tasks, generate more pipeline than manual outreach, and achieve up to three times higher response rates.

4. How important is personalization in B2B lead generation?

Personalization is crucial. Highly personalized outreach can achieve 15-30% response rates, compared to just 1-3% for minimally personalized messages. Effective personalization should reference specific prospect activities and industry challenges.

5. What are the key challenges in using LinkedIn for B2B lead generation?

Major challenges include maintaining personalization at scale, adhering to LinkedIn's strict daily outreach limits to avoid account restrictions, and overcoming limitations in analytics and CRM integration.